Everyone’s talking about customer engagement — but why is it so important, and what does it really mean? How does customer engagement look in action, when you’re a business trying to connect with your customers today?

Customer engagement is about inspiring your customers to interact with your brand and willingly take part in the experiences you’re creating for them. If you do it right, you’ll grow your brand and build customer loyalty — and, in turn, drive revenue.

Successful recovery relies on the customers willingness to engage, so organisations can affect customer behaviour in a way that will have the customer clear their arrears.

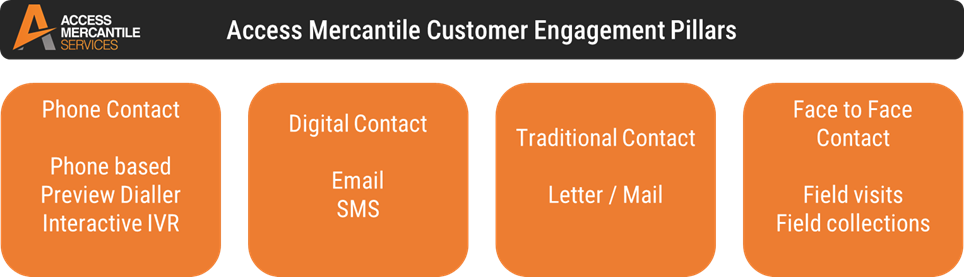

Best practice in the collections space today is all about providing customers who want engagement with a greater range of choice and effectively opening as many different channels as possible in order to facilitate the engagement process. Digital interaction is fast gaining ground as a preferred method of customer interaction. The immediacy of SMS text messaging and email can be effective and is proving increasingly popular.

What happens though when a customer doesn’t respond to calls or digital contact? Call blocking has begun to decrease customer contact. SMS and email can go unanswered.

Access Mercantile provides for an often overlooked contact method – face to face. Access Mercantile through its ACE collection method has shown proven results in increasing customer engagement. Access Mercantile’s field services are a great way to integrate into the credit ecosystem where agents will visit face to face with customers. With the highest standards, field visits are effective as customer’s engage with an agent at their door. Our agents are fully trained to enable full collection, payment arrangement, hardship identification or even to simply make contact to have the customer engage with your team.

Access Mercantile selects its agents based on their willingness to work hard, being curious and enthusiastic about recovering collections and maintaining customer satisfaction. Our agents are critical to success, trained in open communication and treating debtors like human beings. Through this balanced and integrated approach, recovery activity can be a positive customer experience. The Access Mercantile team is trained to a high level in customer engagement, effective collections conversations, hardship, customer vulnerability, leadership and well-being.

Providing the customer with multiple ways of interacting with the business, ultimately leads to better dialogue, a more engaged customer base, and increased, and faster, revenue collection. To learn more about Access Mercantile’s fully integrated ACE model, reach out through corporate@accessmercantile.com.au